Becoming part of the EU single market is not just about trade—it’s about investment, economic modernization, democratic progress, rule of law, and better regional cooperation. In recent years, several initiatives have been adopted to foster regional economic integration, including the Common Regional Market Action Plan 2021-2024. These initiatives aim to build a common regional market based on EU rules and regulations and on the four freedoms. They are intended to be a stepping stone for Western Balkan economies to better integrate into European value chains and improve their competitiveness. The initiatives have focused on four main regional areas: trade, investment, digitalization, and industry and innovation. The establishment of “green lanes”—streamlined border crossings for freight vehicles—during the COVID-19 pandemic was a successful example of regional cooperation.

The Berlin Process, a very important initiative that has pushed for faster economic integration with the EU, has also been revitalized, and the next meeting will be held in Albania in October. The Open Balkans Initiative, another project that started as an economic cooperation agreement among Serbia, North Macedonia, and Albania in 2021, has also offered some practical steps for better economic cooperation in the region.

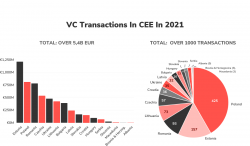

Regional economic integration is imperative for the Western Balkans to benefit from bigger markets and greater competition by fostering cross-border production chains and leveraging regional comparative advantages. To attract the interest of serious foreign investors, it is necessary to cooperate in a “pooled” competition for foreign direct investment. This will help countries to improve their competitiveness by incentivizing technological and industrial clusters, as well as help modernize their economies, facilitate innovation, and improve skills and productivity.

As European companies are looking to relocate their supply chains closer to home, investing in the Western Balkans for the production of critical goods would contribute to the EU’s strategic economic autonomy, following through on the “de-risking” goals that occupy a key place in the EU’s newly published European Economic Security Strategy.

In this context, Scalable Global Solutions (SGS), operating from Croatia within the Western Balkan region, plays a pivotal role. SGS offers SME businesses across Europe a unique digital service known as ‘Department as a Solution (DaaS).’ DaaS allows businesses to create remote Business Departments on demand, streamlining recruitment, facilitating office setup, and enabling effortless management of remote teams, all in one place through SGS’s software and mobile app. This innovative solution is helping businesses expand their operations efficiently and cost-effectively, aligning with the goals of regional economic integration and enhancing competitiveness.

Developing European industrial clusters in the Western Balkans would increase the EU’s competitiveness, including in key areas such as green and solar industries, biotech, and electric vehicles. Ports in the Adriatic Sea are important for the resilience of trade routes and hold potential for investment in liquefied natural gas transportation as well.

Lower labor costs in the Western Balkans and strategic connectivity in terms of energy and transport make the region attractive, but what is needed is more EU investment to improve infrastructural networks. EU investment in strategic infrastructure projects in the Western Balkans to boost interconnectedness would also counter China’s increased economic and diplomatic footprint in the Western Balkans. This growing footprint challenges European business interests and fuels practices that hinder the EU’s ability to enhance the promotion of Western norms and standards.