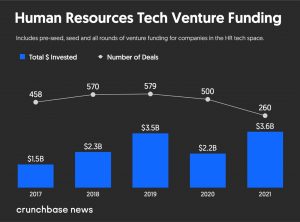

HR Tech Startup Funding Scene is on Record High Levels

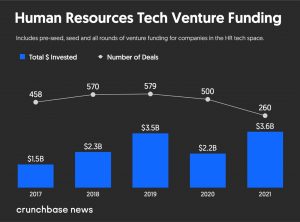

The latest report from Crunchbase News indicates that funding for the HR tech sector is on an all-time rise, with 260 closed deals this year alone (total value of $3,6b), and 500 done deals last year. This is just a confirmation that more and more companies are dealing with a new way of doing business and that the modern workforce is evolving and transforming. There is an increase of companies seeking new ways of recruiting, hiring, and keeping their workforce while making every penny and cent count. Below is a 5-year graph showcasing the venture funding of HR tech-oriented startups.

Source: Crunchbase News

In the first two weeks of this month, 17 financing rounds in the HR tech area have been revealed. “You’re simply seeing very competitive rounds,” Adam Boutin, a partner at Capital One Growth Ventures, said. “HR technology has grown quite hot in the last two years or so.”

A “nexus” of events

According to people in the business, several themes appear to be combining to make human resource technology attractive to investors right now.

With the demand for talent only growing, employees expect more employment, making them more challenging to keep. Add to that a pandemic that has fundamentally changed how we work and organizations wanting to update from previous generations of HR IT stacks. Everything appears to be aligning for a huge investment moment.

“I’m not surprised,” said Job van der Voort, co-founder and CEO of Remote, whose latest investment was headed by Accel. “Demand for talent has never been stronger, and the recent year has only hastened workforce changes. Work is entirely backwards, and there is no script for it.”

According to Saad Siddiqui, a principal at Telstra Ventures, everything in human resources is changing from how talent is acquired to training to attempting to establish a business culture where workers no longer meet each other in person.

“This all poses challenges,” said Siddiqui, whose business recently participated in the fundraising of Certn, a Canadian application screening startup.

One of the most challenging issues for organizations in HR IT, according to Siddiqui, is figuring out how to retain their “culture” in the new remote-work era.

“There will undoubtedly be more investment here,” he said. “Everyone has spent the previous 16 or 18 months working (remotely), but no one is having fun. So the question is, how can it be made more enjoyable?”

Faster – Higher – Stronger

This summer alone, three venture financing rounds in the HR tech sector exceeded $200 million. Workers, headquartered in Austin, raised $300 million in June, while Eightfold, based in Santa Clara, California, and Gympass, based in Brazil, closed $220 million Series E rounds last month.

Boutin, whose firm also participated in the Eightfold raise and is an investor in the San Francisco-based automated skills-based assessment platform CodeSignal, believes that the introduction of machine learning and AI has been a game-changer for HR tech in recruiting, retention, and performance management.

This is especially true since firms recognize the importance of their employees more now than in the past.

“Companies have traditionally seen human resources as a cost center,” he explained. “Because it didn’t increase sales, they didn’t want to spend money there.” However, more individuals recognize that people are to their advantage.”

Companies are trying to figure out how to “fish for talent in different ponds” to get that “people advantage,” according to Boutin, by using technology to help figure out what candidates may be a good fit for jobs based on their skill set rather than just the job they may have applied for through an overly simplistic online search.

The growing demand for greater diversity and inclusion is also forcing organizations to discover new methods to locate and engage with talent.

Finally, HR departments will be searching for technology that will help them streamline procedures for the remote — or fluid — workforce.

“The onus is on us to make things a lot simpler in this fluid workforce,” he added. “It is the HR department’s responsibility to make this work in this new environment.”

Regardless of how firms depart, more M&A and IPOs will increase investor interest in the area.

“As investors begin to see profits, it becomes simpler to double down, and values just rise,” Siddiqui explained.

Scalable Global Solutions is a Tech DaaS [Department as a Solution] provider that enables clients to hire the best of the best Croatian workforce and build whole departments in Zagreb, Croatia. With a revolutionary combination of Workforce and Software as a Solution, we bring something new to the market.

Right now, we are in our second fundraising round, Seed level, where we want to boost our Sales and Marketing team and expand our Channel Program. Our goal is to raise €5M by the end of 2022, with €250k already invested. For more information, please visit our Investor’s Corner.

Source : Crunchable News

The newest round of EU financing, which includes recovery funds, is anticipated to spur investment in emerging sectors such as renewables, electric cars, power storage, and hydrogen technologies.

The newest round of EU financing, which includes recovery funds, is anticipated to spur investment in emerging sectors such as renewables, electric cars, power storage, and hydrogen technologies.

declaration of incorporation signed by the creator in the form of a notarial act. On the day of his entry into the Court Register, he gains legal personality.

declaration of incorporation signed by the creator in the form of a notarial act. On the day of his entry into the Court Register, he gains legal personality.